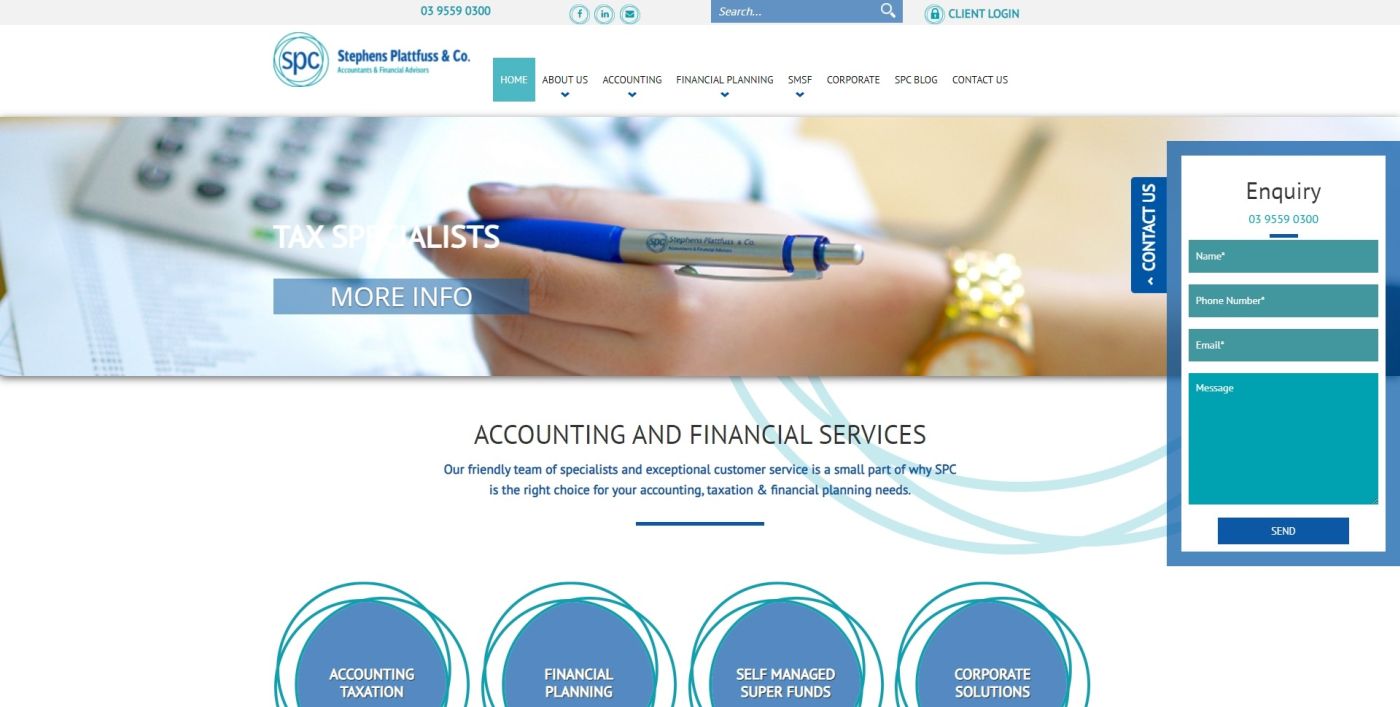

Stephens Plattfuss & Co Pty Ltd

Email: email@spcpl.com.au

Website: http://spcpl.com.au/

Phone: 0395639741

ACCOUNTING AND FINANCIAL SERVICES

Our friendly team of specialists and exceptional customer service is a small part of why SPC

is the right choice for your accounting, taxation & financial planning needs.

ACCOUNTING TAXATION

FINANCIAL PLANNING

SELF MANAGED SUPER FUNDS

CORPORATE SOLUTIONS

STEPHENS PLATTFUSS & CO

Certified Practising Accountants with a client focus and a strong expertise in tax, business services and advisory

Here at Stephens Plattfuss & Co. we have a strong focus on transparency and integrity. We believe it is these core values that assist us in supporting our client’s goals in the best possible way

Personal Accounting Services Melbourne

Most people never realise how much money they could save by hiring an accountant. Without accountants, many people pay too much tax. They overlook tax deductions or fail to take advantage of the benefits of entity structuring or utilising entities that pay tax at a lower rate. What they don’t realise is that accountants have an arsenal of legal tax minimisation strategies that most people aren’t aware of. With a qualified accountant, you’ll not only pay less tax but save yourself the stress of doing it all yourself.

Why SPC?

So you’ve decided to get an accountant, that’s just the first step. Choosing the right person can be a daunting task. Many accounting professionals out there will do a quick job on your tax return and leave you as confused by the process as you were before you hired them. At SPC we strive to be different, our tax accountants will explain accounting jargon in plain language, assisting you with our knowledge so that you can make the best possible decisions regarding your taxation and accounting position.

At SPC, our team of accountants strive to build long-term trusting relationships with our clients.

Business Accounting Melbourne

Professional business accounting allows you to track your business’s progress and steer its growth. Without proper accounting, or by doing it yourself, you take many risks including incorrect set up or legal structuring of your business, and ending up with a mess of records and bookkeeping. These mistakes stunt your business’s progress, and leave you vulnerable to fraud or failure.

Hiring a business accountant will improve your business operations and enable your venture to flourish. Whether you’re in need of accounting as a sole trader, partnership, trust or company, we simplify and streamline your accounting, and explain each step in plain and clear terms.

Here’s how you can benefit from SPC’s accounting services:

- Pay less tax: Correct entity structuring, ongoing accounting and taxation services mean you pay less tax. We’ll let you in on tax minimization possibilities you may not know about, and get your tax returns filled in on time without the headache. Read more about our business taxation services.

- Improve strategy and operations of your business: SPC provides accounting services and management reporting that boost the day to day operations of your business and shed light on directions for future growth. Read more about management reporting.

- Set up for success: Our entity structuring and legal structuring services are the best way to set your business up for success. Structure your company correctly from the get-go and it can only grow bigger and more profitable. Read more about entity structuring.

- Prepare for audits: We’ll help with ongoing accounting that keeps records and paperwork in check. Should you be called upon for an audit, we’ll guide you through it, transforming what could be a difficult and stressful process into one that’s easy and pain free. Read more about accounting for audits

Take the headaches and stress out of taxation accounting. Build a relationship with the accountants at Stephens Plattfuss & Co.

Financial Planning

If you’re looking at growing your income, increasing your investments and generating more assets, then you’re in the business of Wealth Creation. You may have some idea of what you want but lack the know-how to achieve it. Our financial planners are here to clarify the process and even unveil wealth-accruing possibilities you never knew existed. Stephens Plattfuss & Co. Financial Services Pty Ltd will give you financial advice and show you all your options so you can make informed, confident decisions.

Wealth Management Melbourne

At Stephens Plattfuss & Co. Financial Services Pty Ltd, we believe that there’s only one way to effectively grow your wealth and that’s through holistic wealth management. It involves tying together all your financial needs and viewing them as a whole in order to make decisions. Separating your taxation, investment and retirement needs doesn’t work because they impact on one another to form a bigger picture. Only a comprehensive service can get you the results you want. Let a Stephens Plattfuss & Co. Financial Services Pty Ltd adviser take care of your wealth management and watch your money grow.

Cash Flow Management

Do I need cash flow management?

Every business, from the smallest to the most successful ventures need cash flow management. Cash flow management is not just a security net but a long term strategy for your business’s success. Customer and supplier payment terms, loan repayments and the future spending of your business need to be managed with care to prevent your business from sudden failure or foreclosure. And a boost to your cash flow can you see your business profiting more than ever before. Make your business a success with sound advice from our financial advisors.

Self Managed Super Funds – SMSF Melbourne

In recent times more and more Australians are opting to seize control of their Super and reap the financial benefits offered through self-managed super funds (SMSFs). Whether your aim is to nurture your savings or grow your super, personalised SMSFs can be implemented with a suitable strategy to help you meet your goals. Our team of specialists can help get your super to work for you.

We can help you maximise the performance of your fund as well as ensure your SMSF is operating in accordance with the complex superannuation and tax laws that govern them so you are free to enjoy the benefits.

Why choose a self-managed super fund?

The benefits of SMSFs are commonly spoken about but what exactly are these benefits and what do they mean for you? Let’s break them down.

- Lower fees

In comparison to traditional institutionally managed superannuation funds, which charge maintenance fees as a percentage of your Super fund balance, SMSFs fees won’t increase as your portfolio grows.

- Flexibility of investment choices and asset selection

Through SMSFs you get to decide how to use your money. Whether that be purchasing property, investing in shares, managed funds, term deposit etc. By providing this control over your investments you have the ability to adjust the risk profile of your SMSF to suit your lifestyle.

- Have up to 4 members

SMSFs allow you to have between 1-4 members. This allows individuals with similar financial interests to pool their resources to create a mutually beneficial SMSF. For example a family unit such as parents and adult children.

Corporate Solutions

SPC Corporate Solutions Pty Ltd is a division established within the SPC Group to assist our clients with corporate entity establishment and structure.

There are various processes involved with regards to establishing either a company, trust or SMSF, and it is vital that all relevant documentation is created in the beginning to ensure compliance with the relevant legislation.

The aim of creating this division is to ensure that all services offered and provided, including entity structuring and ASIC compliance, are integrated harmoniously with our accounting division. Our specialists take care of these crucial and time-consuming tasks so our clients are free to focus on what matters – growing their entity.

Our professional advisors can offer you the following services in relation to the establishment of your company, trust or SMSF:

- Company registration- including preparation of Company Constitutions, minutes of meeting and company establishment documents

- Business name registration

- Discretionary and Fixed Unit Trust establishments – including preparation of Trust deeds, minutes of meetings and trust establishment documents

- Preparation of ASIC Annual Company Statements

- Set up ABN and TFN

- SMSF Establishment

- SMSF Deed updates and change of trustees

- Limited recourse borrowing packages – including SMSF, trustee, custodian and bare trust establishment

- Pension conversion and purchases

- Actuarial Certificates