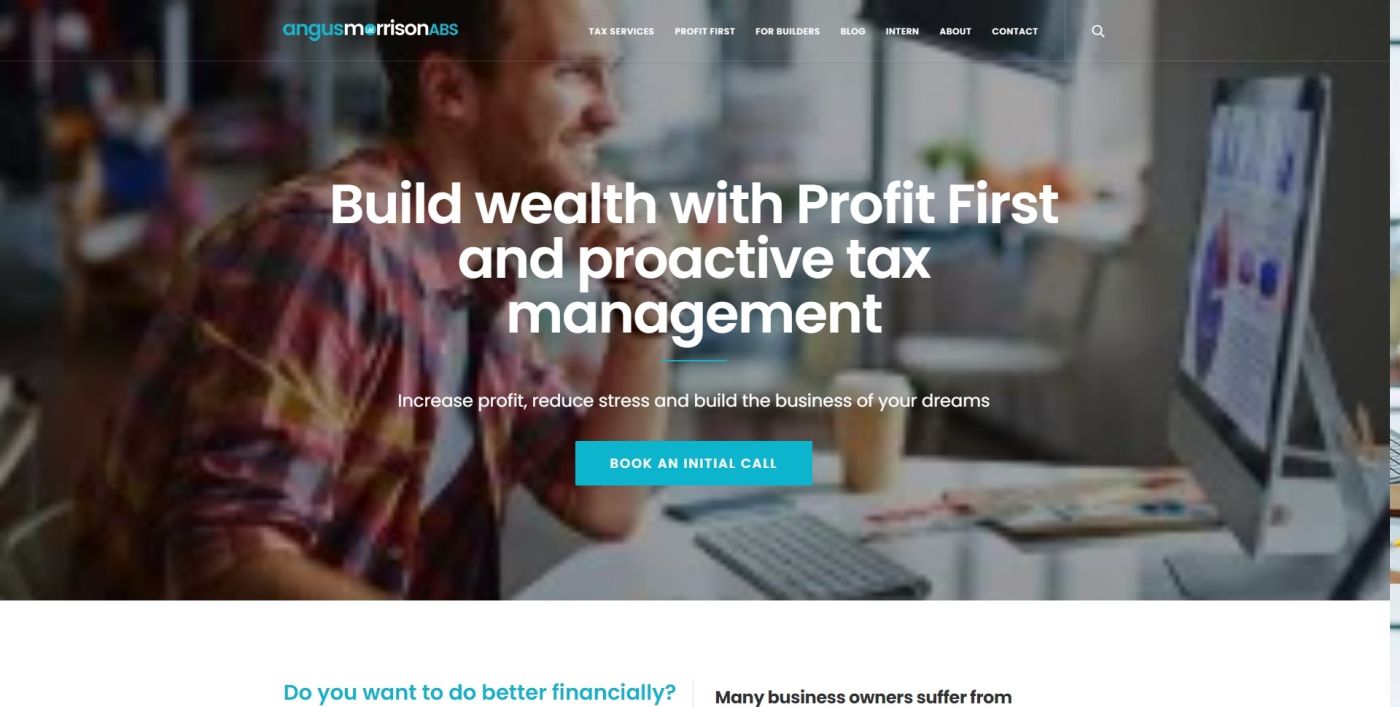

Angus Morrison Accounting & Business Solutions

Email: angus@morrisonabs.com.au

Website: http://www.morrisonabs.com.au/

Phone: +61395846421

Helping create your financial success

Want to know if we may be a good fit? Here’s some information that may help.

Chartered Acccountant

As a Chartered Accountant, I’ve taken the highest level of training the accounting industry offers.

Profit First Professional

As one of the first certified Profit First accounting practices in Australia, I’m qualified and experienced with helping businesses set up the Profit First cashflow system. Check out the Profit First page on this website for more information.

Tax Expertise

I’ve been working full-time in tax and business advice for nearly 10 years. This means I have dealt with countless complex tax issues that will ensure I can deal with any tax issue you may have.

Financial analysis and planning expertise

Prior to working in tax, I worked in financial planning and analysis. This has equipped me with the knowledge and skills to analyse your business and work with you to understand exactly what you need to do to create increased profits, growth and reach your financial goals.

Business Founder/Entrepreneur

In 2002, I founded the All Nations Sports Leagues in London, with social netball, touch rugby and soccer leagues in 4 venues catering for over 1,000 people each week. Since 2003, I’ve managed this business remotely with an amazing team, some of whom are now co-owners. The leagues now operate in London, Edinburgh and Glasgow. Check out www.theallnations.com, www.netballislington.co.uk and allnationsnetball.com for more information.

Other information

Check out the blog and case studies for some ideas about some of the ways I may be able to help.

Get in contact

Tax advice, planning and compliance services

How it works

Tax management with BAS’s and annual tax returns and tax planning and advice, so that taxes are minimised and more easily managed.

Monthly tax forecasting, so you know where you are at

Answers to complex tax questions

What makes our Profit First service different?Our Profit First Financial Review

- Initial financial review examines all aspects of your business’s finances

- Create understanding of how to increase profit

- Obtain a clear Profit First Plan for your business

- Manage all Australian taxes with your Profit First plan

- Experienced – 1st Profit First Professional qualified in Victoria

Not making the profit you want?

Worried about cashflow?

Accountant not really helping?

We can help

- Building industry experts

- Experts in Buildxact, Buildertrend and SoloAssist

- Increase cashflow

- Quote profitably

- Manage costs

Work with a building expert

Feel like you could be doing better with your taxes?

Paying too much tax?Not in control of taxes?Unsure how much you will have to pay?Have complex tax issues or questions?

If you answered yes, you’re probably experiencing:

- High taxes

- Poor corporate structures

- Lack of planning

The good news is, we can help!

What makes our tax services different?

We constantly plan and forecast

- We have significant tax expertise

- We talk your language rather than accountant-speak

- We constantly plan so you are always in control

Most accountants don’t have the expertise to help manage your finances

Quoting, work-in-progress, variations, cost control. There’s a lot to know.

- We are qualified to help.

- We have assisted many business just like yours.

- We are experts in building software and cost management