Melbourne mortgage brokers can be a valuable resource for a home loan. They can assist you in comparing various lenders and products and the paperwork and application procedure. However, keep in mind that most mortgage brokers charge a fee for their services. So, when you employ one, make sure you enquire about the price and what's included. Make sure you browse around for the greatest price. Then, you should be able to discover a mortgage broker in Melbourne who suits your needs.

They can assist you in comparing different lenders and programmes and guiding you through the mortgage application process. Here are some pointers to help you select the finest Melbourne mortgage, broker.

Ultimate List Of Mortgage Brokers in Melbourne, Victoria

EWM Accountants & Business Advisors - Mortgage Brokers Melbourne

03 9568 5444

About EWM Accountants & Business Advisors - Mortgage Brokers

Chartered Accountants at EWM Accountants and Business Advisors assist small businesses with accounting, bookkeeping, and taxation needs. We have assisted small businesses for over 30 years and specialize in construction, investment, medical, dentistry, and manufacturing. The firm comprises a group of skilled accountants who provide a lot of knowledge to assist us achieve our mission. It is based in Oakleigh in Melbourne.

Our Vision

To be the only accounting and taxes small company advising firm, we must assist our customers in recognizing and shaping their future potential.

Our Mission

To assist families in transforming their businesses into new-age firms that will thrive in the next decade and beyond. Every day, we help our clients on their route to success †"they choose their path, and we help them. Our clients define success for themselves, and we accompany them on their path and take great pride in their accomplishments.

Our Services

Business Accounting Services

- Melbourne Business Accounting Services - We emphasize growing our clients' businesses and profits and managing the rigorous requirements of complicated compliance and regulation. Our staff of highly certified accountants, bookkeepers, and financial strategists is fully trained and experienced in implementing best practice financial management standards in Melbourne to support your accounting and processing needs. Our streamlined regulations and procedures simplify outsourcing your finance function while also providing important experience to your team and company.

Taxation Services

EWM Accountants will assist you in achieving your objectives. Offering the finest in tax administration and management necessitates flexibility, cost-effectiveness, consistency across the board, and, most significantly, the ability to comprehend your own or your company's unique needs. EWM Accountants & Business Advisors' tailored tax solutions allow you to be flexible, adapt, and make changes when and how you need to, ensuring you get the most out of your cash flow.

Our Taxation Services

- Income Tax Advisory

- Salary Packaging

- Payroll Tax

- Capital Gains Tax

- GST

- Managing Tax Risk

- Tax Planning

- Structuring

- Fringe Benefit Tax

It is possible to make valid, legal decisions that considerably influence the tax you pay, depending on your circumstances. Make sure you're claiming all of the tax breaks you're entitled to.

Proper Finance Mortgage Broker Melbourne

03 8620 9099

About Proper Finance Mortgage Broker Melbourne

We at Proper Finance aim for quality in everything we do, and we look forwards to assisting you in achieving your financial objectives. We think lending products should be simple to comprehend, accessible, and provide you with peace of mind. Consider us a professional resource like you consider your accountant, financial planner, or lawyer. You can count on us to always put your best interests first. We will work with you and your service providers (real estate agent, conveyancer, and lender) to ensure you get the financing that best meets your circumstances and needs throughout your purchase or refinancing process. You will speak with a live person when you call Proper Finance. We'll walk you through the entire financing process, giving information and help. Please contact us to find out more about how we can assist you right now.

Our Services

We are excited to assist you with your financial needs. We can assist first-time buyers, repeat buyers, refinancing customers, and investors. Check out the list of services we provide below or contact us to discuss your specific needs. There are hundreds of loan products on the market today, and it is our goal to help you locate the best fit for your needs and capacity to service them. We take pleasure in providing prompt service and assistance. We have a lot of experience with everything related to loans, including:

Helping First-Time Homebuyers

You're just getting started and aren't sure what kind of Loan you'll need? Don't be concerned! We are here to assist you. With our help, you can receive financing from a financial institution (a loan) to purchase or secure the property as a first-time homebuyer. The size of the Loan, its maturity, the interest rate, the manner of repayment, and other mortgage parameters can all vary significantly. To discuss your alternatives, it's always better to consult with a competent mortgage broker. We can also assist you in determining your eligibility for the First Home Owner's Grant and applying for it.

Loans For Investment

Investment loans are designed to help you make the most of your assets and financial resources. We can work with your financial advisor and accountant to ensure that your Loan is tailored to your needs, and we have access to competitive lending choices that can help you maximize your investment returns.

Business Loans

Lender websites rarely contain information about commercial property and company loan policies and interest rates. However, unlike residential house loans, the price of a commercial loan can be negotiated based on your business experience and the security you're willing to provide. Simply contact us today if you need assistance refinancing or purchasing commercial property.

Loans With Standard Variable And Fixed Rate

The rate is usually higher because the variable rate loan has more options and flexibility than a standard fixed-rate loan. Fixed-rate loans have a fixed interest rate for a given period, usually one to five years. This benefits you by knowing how much your repayments will be, allowing you to plan your finances without the risk of interest rates climbing. However, this benefit is outweighed by the potential of missing out on a rate decline.

Loans For Honeymoon

A honeymoon loan (or introductory Loan) has lower interest rates and repayments for the first six to twelve months. Following the 'honeymoon' period, the Loan converts to a conventional variable rate loan, with repayments adjusted to reflect the current standard variable interest rate. When taking out a honeymoon loan, make sure you'll be able to afford the Loan's potentially higher instalments in the future. If you want to convert to a different loan form at the end of the honeymoon period, you may be charged a fee.

Loans For Bridging

A bridging loan may be required to bridge the financial gap between purchasing a new property and selling your old one. The old property (using equity) and the new property being purchased are used to secure this Loan. Bridging loans are often short-term (usually 6 months) and more expensive than other forms of loans because they allow for the sale of the original property. There are various methods for financing a move from one home to another, so please contact us to discuss them.

Finance Of Assets

Do you require financing for a significant purchase other than your home? You can also ask us to help you find affordable financing for personal vehicles and recreational vehicles, commercial vehicles, business plant and equipment, and other types of small business loans. Personal loans, car loans, various leases, commercial leasing alternatives, chattel mortgages, and other financing options may be available. The main advantage of hiring a broker to finance other substantial purchases like real estate is that you can get financing suited to your specific financial situation and demands. In addition, the correct financing for depreciating assets can save you money on interest and fees and help you maximize your tax benefits.

Mortgage Choice Melbourne Broker

03 8602 6777

About Mortgage Choice Melbourne Broker

For over 30 years, Mortgage Choice has provided a variety of solutions and a team of trusted professionals to assist Australians in financing their homes, investment properties, cars, and businesses. Mortgage Choice began in 1992 to establish a nationwide network of ethical, trustworthy, and knowledgeable mortgage brokers. Thirty years later, under new management at REA Group, we are still a nationally recognized and trusted brand. Whether buying a house, a new automobile, or starting a business, we're committed to helping people achieve their objectives. Our Customer Charter explains our service, payment method, privacy policy, and complaints system. Mortgage Choice has been a wholly-owned subsidiary of REA Group Ltd since July 1, 2021. Mortgage Choice is licenced in Australia under number 382869. FinChoice Pty Limited, a wholly-owned subsidiary of Mortgage Choice, is licenced in Australia under number 422854. ASIC is responsible for both licences.

Our Service

Every 15 minutes, we settle a loan. Finding the appropriate house loan can be difficult with so many options available. Your Mortgage Choice broker will handle your home loan from beginning to end, providing you with the peace of mind of expert advice and ongoing support. We won't stop until we've found you the best house loan for your specific needs, thanks to our access to over 30 lenders and hundreds of various home loans.

Home Loans

- Get started today

- Buy a property

- Refinancing

- Property investing

- Buying land

- Mortgage Choice Ignite

- Mortgage Choice Propel

- Mortgage Choice SmartSelect

- Mortgage Choice Amplify

- Home loan health check

- Expert advice

- Home loan features

- Loan types

- Lenders Mortgage Insurance

- Home loan deposit

- Home buying costs

- Home equity

- Tax and gearing

- What is rental yield?

- Home loan guides

- Homeownership

- First home buyer

- First homeowners grant

- Home loan guarantors

- Refinancing

- Property investing

- Next home buyers

- Building your home

Business Loan

- Business lending

- Equipment finance

- Commercial property

- Business loans

- Car loans for businesses

- Small business loans

- Warehouse loans

Melbourne Broker Mortgage Advice

melbournemortgageadvice.com.au

1800 693 000

About Melbourne Broker Mortgage Advice

Melbourne Mortgage Advice has provided expert home loan advice and support for over 20 years. Our firm, founded by Jon Ward, a former ANZ Bank Manager, prides itself on developing long-term client connections and working tirelessly to help homeowners and investors prosper. We have never been more positioned to produce great results for our clients than with the addition of Paul Lewis and John Waters to the Mortgage Broker team. We've helped hundreds of people reach their goals by providing well-structured loans, competitive rates, and excellent customer service.

Our Purpose

To give our customers more options, better rates, transparent guidance, cutting-edge education, and unmatched customer service. We want to be the mortgage broker that Melbourne borrowers turn to when they need the best home loan advice. We consider it a tremendous honour to assist people in realizing their real estate goals, and we treat this opportunity with the respect it deserves. Our motto is to under-promise and over-deliver.

Our Services

Home Buyer Loans

Buying a home can be one of the most exciting times in anyone's life. However, many things to consider when making such a big step and looking for a home loan. Our expertise and experience with home loans can guide you through the entire process, from the 'idea' stage to getting the keys in your hand.

Your Home-Buying Adventure

One of the most exciting things you will do in your life is to purchase your own home. Take the time to learn all the stages first to ensure that you like the procedure. We'll be here to assist you and provide personalized service and support throughout the process. Whether you're just interested or planning to buy a house soon, the first step is to figure out how much you can borrow. You can start house hunting after we finish arranging your home financing.

- Pre-approval: We'll assist you in obtaining the appropriate approvals so you may confidently buy or bid.

- Purchase your home and complete all paperwork; you're almost there.

- Obtaining the keys It's time to organize your housewarming now that you're a legal homeowner!

Essentials Borrowed

We're here to assist you in better understanding your financial situation and borrowing capabilities. However, to determine how much you may borrow, you must first determine your financial goals and conditions.

- Eligibility for a home loan: To be eligible for a home loan, you must meet certain acceptance criteria to a lender. What exactly is a lender? A lender is someone or something that gives credit help, such as a loan. They could be banks, credit unions, or other financial institutions. Lenders will look at your employment and income history and any outstanding debt and credit history you may have. You must also have a sizable deposit saved to satisfy lenders. Lenders want to know that you are financially secure to make timely repayments on your Loan. Book a complimentary, no-obligation consultation with us today to determine if you're eligible for a home loan or learn how much you may borrow.

- Credit report: After speaking with a broker and deciding to proceed, you must choose a lender. The lender will run a credit check and evaluate your financial history, including any previous credit applications and payments you've missed. We're here to ensure that the lender follows through on all of the steps necessary to get your loan promptly. You must review your credit report. Please let us know if there is anything on your report that you believe could jeopardize your application as part of your application.

Melbourne Blutin Finance Broker

1300 188 808

About Melbourne Blutin Finance Broker

We are a small, independent mortgage brokerage dedicated to assisting you in finding the best house loan, investment property loan, commercial property loan, or business loan for you. We have all the expertise necessary to make your trip as seamless and comfortable as possible as seasoned professionals. We take the time to learn about your financing requirements, work with you to understand your alternatives and find the most cost-effective loan options for you.

Our Service

First-Time Homeowners

It might be scary to enter the real estate market first. But, it doesn't have to be that way, and having a companion who can hold your hand during the procedure will make the experience much less stressful and even exhilarating. Blutin Finance can walk you through the entire process, including any government assistance available to first-time home purchasers.

What Is The Lvr (Loan To Value Ratio)?

The LVR is the proportion of a property's purchase price that a lender will allow you to borrow – and consequently, the amount of deposit you'll require. We can assist you in determining your LVR and the total deposit required to receive a loan for your investment property.

Loans To Businesses

If you want to utilize the money for commercial reasons, you can apply for a business loan. For example, you might wish to establish a new business and require financing. On the other hand, you may already have a business but require additional funds or wish to purchase equipment.

Frequently Asked Questions About Mortgage Broker

The average salary for a mortgage broker is $85,813 per year in Melbourne VIC.

In most cases, mortgage brokers are paid an upfront commission and a trail or ongoing commission for the business they bring to the bank. These commissions are paid out only once your home loan settles. The commissions are based on a percentage of the loan amount and the LVR.

It takes between 4 and 8 weeks to get a formal mortgage offer from acceptance of an offer. Ideally, you will already have chosen a mortgage lender. You will have asked the lender for a Decision in Principle (DIP).

Do you need a mortgage or agreement in principle to make an offer? In principle, a mortgage or agreement is not needed to make an offer, but having one when shopping for a house will give you a better chance of getting your offer accepted for a house, as sellers will take you more seriously.

Some lenders work exclusively with mortgage brokers, providing borrowers access to loans that would otherwise not be available. In addition, brokers can get lenders to waive applications, appraisal, origination, and other fees.

YouBroker - Mortgage Brokers Melbourne

1300 733 942

About YouBroker - Mortgage Brokers Melbourne

We're switching mortgages. Home loans, in our opinion, should be much more digital. So we go beyond conventional comparison sites and delayed service for house loans and instead take an Amazon approach.

What Differentiates Us?

Trusted

The team at YouBroker is ASIC-licensed and fully insured so you can trust their home loan advice.

Pleasant And Simple

We explain everything in plain English so you can make informed judgments.

Smart

We leverage technology and smart processes to make our clients' lives easier.

Prepared

We will advise and provide you with knowledge and support so that you may feel confident in your financial decisions.

Our Services

YouBrokers smart mortgage platform makes it fast and easy to drive your mortgage pre-approval or refinance.

Rates And Banks Can Be Compared And Filtered.

Check out the greatest prices and offers. With our Loan Shortlister, you can take command of your loan decisions.

Qualify And Shortlist

Choose your favourite loans and check your eligibility. Our credit experts double-check your borrowing options and quantities, so you don't jeopardize your credit score.

Form For Smart Application

Why put your personal information at risk on several websites? With our FastFill technology, you can easily apply on our web portal.

Settle & Track

Don't be caught off guard! From start to finish, track the development of your Loan online with digital tracking and updates at each stage.

Mortgage Fidget JP Partners Brokers

1300 129 459

About Mortgage Fidget JP Partners Brokers

We think that everyone deserves the greatest service and advice at Fidget JP Partners Financial. We exist because of our clients, and we will never lose sight of that. We have you covered with a broad range of financial products and services and our experience, competence, and constant client-first focus. Professional, passionate & highly experienced. With over 32 year's financial services experience in all facets of the industry, we have paid our dues and amassed a massive amount of experience and knowledge. We use that knowledge, experience, and talent to give our clients unparalleled service and insight. We love what we do, are outstanding at what we do, are fiercely proud of what we do, and love helping people. It's just that simple.

Our Services

Lending

We're here to help you get what you want if you need to borrow money. Of course, it's critical to get the appropriate product at the right price, but we go well beyond merely assisting you in selecting the "perfect product." We give you the information, expertise, and direction you need to make the best decisions for you.

Assisted Leasing

Do you want that "new car" sensation? Consider paying less tax. You can now have your cake and eat it as well. A Novated Lease is a terrific method to get that new car you've always wanted. A mix of pre-and post-tax revenue covers your car loan, insurance, maintenance, and operating costs. As a result, you can save a lot of money on your new car. Even if your employer already has a Salary Packaging business caring about you, we can assist you with your Lease. We can also get you a great price on a new car with our Car Buying service.

Insurance

Everyone requires it, but no one desires it - we have it. But horrible things happen to decent people... and the consequences can be devastating. Imagine losing your house due to an accident – or, even worse, leaving your family with nothing and no way to pay the bills if you die. We can help you with that. We recognize the need to balance protecting your family and living your life. We'll show you how to have it all. Now you can relax.

Programs

- Do you wish to be debt-free? How about some assistance in preparing to purchase your first home?

- Perhaps you're trying to put together a nice little nest egg or planning an investment property?

We have special, in-house programmes that can assist you in accomplishing these goals and more. Our programmes are simple, rational, and, most importantly, effective. We'd be delighted to tell you everything there is to know about. We have you covered with a broad range of financial products and services and our experience, competence, and constant client-first focus.

My Mortgage Freedom Melbourne

03 8256 1914

About My Mortgage Freedom - Melbourne

When Anthony was working for financial planning and accounting firm in 2011, the seed for MyMF was planted. They were directing their consumers to external mortgage brokers and were consistently disappointed. According to Anthony, home loan applicants were being underserved, their experience was disjointed and upsetting, and they were frequently left in a panic over the entire process. Because there was no other option, customers were compelled to accept mediocrity because the industry had not accepted new technologies or evolved.

As a result, MMF set out on a quest to reengineer the entire home loan process from beginning to end. They focused on customer service, contact, camaraderie, communication, and staying one step ahead of the competition to deliver the best service possible. They delivered internet solutions before the online frenzy in 2011-2014. But they weren't just interested in being online, MMF is a people business, and their client interactions set them apart. So when the online space grew congested in 2014, with banks and brokers paying $$ for leads, MyMF shifted gears and focused all of its attention on engaging with their tribe and being a part of their property journey for the rest of their lives.

It was not as simple as opening the doors and having customers walkthrough. This company needed a clear and defined vision for how it would serve its customers to be "successful." As a result, MMF measures their success not by their development but by the growth of its clients and the influence they have on Australian property enthusiasts' lives. MMF has become one of Australia's leading mortgage providers not by chance but through hard work and constant growth in their process, people, technology, and ability to service their tribe.

Our Services

Our Mortgage Consultants Will Assess Your Requirements.

Our mission is to assist you in achieving the financial independence you deserve. Our straightforward procedure begins with getting to know you better. Then, we determine your financial needs and goals to assist you in finding the correct Loan with favourable terms and rates and planning your route to financial independence. Finally, we'll conduct all of your research, walk you through your options, and answer any questions you may have along the road.

We handle the Application Process.

We'll handle the application for you once you've picked the Loan you'd like to apply for (in other words, we'll handle all the paperwork and communications, so you don't have to). Of course, we'll keep you updated on the status of your application and what you need to do next (hopefully as little as possible).

We handle your Settlements.

We'll also handle the final settlement process once the paperwork is completed and you've signed the dotted line. Our goal is to alleviate all of your concerns about purchasing your first or next home, refinancing, or investing seems as simple as possible. Self-employed? Don't worry. We've got you covered as well.

Mortgage Broker Melbourne

1800 111 626

mortgagebrokermelbourne.net.au

About Mortgage Broker Melbourne

We do the effort, chasing around, and hard work so you don't have to go through the agony that many individuals go through while trying to get a competitive mortgage. We will provide experienced direction and assistance from beginning to end, ensuring that you receive a hassle-free, competitive mortgage. So look no further for a home loan; we have solutions and a wide range of services to suit everyone, from first-time home purchasers to seasoned investors. Some of the most well-known news sites for mortgage brokers, such as Your Mortgage, The Adviser, MPA Magazine, and Australian Broker, have covered Mortgage Broker Melbourne.

Our Services

Buyers Of First Homes

We love the opportunity to assist first-time homebuyers with their property purchase at Mortgage Broker Melbourne. It's an exciting but often nerve-wracking moment for you, so having someone to bounce ideas off and get advice from is beneficial. Your home loan expert in Melbourne can help you with much more than just getting a fantastic rate. Contact us to discover what else we can do to assist you with the process. Melbourne mortgage brokers will:

- Work with you to identify your requirements.

- Take you through the pre-approval process and the procedures involved in buying a home.

- Take care of all the paperwork and keep you updated at all times.

- Be available to offer advice on negotiating with agents, purchasing at auction, and assisting you with the contracts that must be executed in cooperation with your legal representative.

- Organize timelines for valuations, financing, and settlement.

- MBM is available to ensure that your Loan continues to fulfil your needs and is still competitive.

- Free property evaluations.

Grant For First-Time Home Buyers

Mortgage Broker Melbourne will help you apply for the First Home Owner Grant in collaboration with the lender. Click Here to learn more about if you qualify or have any questions. Grant for First-Time Home Buyers

Melbourne Investment Property Loans

Many investor clients have benefited from the services of a Melbourne mortgage broker. Enquire right now to take advantage of our knowledge.

Investment Property Loans Melbourne

Have you come to a halt in your property investment portfolio growth? Have you outgrown your present financial institution? Have you had enough of dealing with banks on your own?

Mortgage Broker Melbourne can help you with the following:

- By overseeing the entire procedure and keeping you updated at all times

- Determine the best loan structure.

- Discuss the difference between interest-only and principal-and-interest repayments.

- Only provide the bare minimum of collateral security to the lender.

- Use a method to reduce the mortgage insurance you'll have to pay.

- You are free to review your complete lending portfolio as often as you choose (which lender does that?!)

Mortgage Relocation

Mortgage Broker Melbourne may assist you in being fully prepared to relocate by obtaining pre-approval first, allowing you to sell and buy with confidence.

Many Consumers Have Relied On Mortgage Broker Melbourne To Guide Them Through The Process Of Selling And Buying Again.

- Calculate the new loan amount you'll need, considering agent fees and the cost of paying off your old mortgage.

- Help you choose the most cost-effective and appropriate products from our diverse panel of lenders.

- If you want to buy before you sell, we can help you with bridging financing.

- Take care of all the paperwork and keep you updated.

- Organize deadlines for values and settlements.

- Examine your house loan regularly, or as needed, to ensure that it remains competitive and meets your needs.

Refinance

Does having to handle a refinance on your own give you the creeps? How does it function? Have you considered aligning the new payment with your pay dates? Are you switching to a cheaper interest rate but unintentionally taking out another 30-year loan? We've considered it, so you don't have to! Refinancing a house loan may be complicated, so having someone working behind the scenes to ensure a smooth process is beneficial. Melbourne mortgage brokers will:

- Work with you to identify your requirements.

- Help you choose the most cost-effective and appropriate products from our diverse panel of lenders.

- Take care of all the paperwork and keep you updated.

- Organize deadlines for values and settlements.

- Examine your loan regularly, or as needed, to ensure that it remains competitive and meets your needs.

Mel Finance Mortgage Broker Services - Melbourne

1800 941 947

About Mel Finance Mortgage Broker Services - Melbourne

Mel Finance provides you with a free property report created by a prominent Australian property data solution business. We now only provide this complimentary service to Melbourne clients. As a forward-thinking brokerage firm, we believe in upgrading technology to provide the best possible service to our clients, ensuring that you receive a seamless experience that meets your expectations. Our up-to-date and comprehensive software will allow us to compare your requirements to hundreds of offers from other lenders. Following the completion of the comparison process, we will present you with a list of comprehensive home loan options, which will include details such as rates, terms, fees, charges, and repayments, all of which will be explained in plain English with no technical jargon, ensuring that all parties understand all details. Working with a local company allows you to readily contact us if you have any questions about your application procedure. It's never been easier to get in touch with us!

Our Services

Our specialized mortgage brokers can assist you in obtaining the finest home loan possible. Contact the Mel Finance team for individualized services for home, business, and investor loans. We are situated in Melbourne and proudly serve clients from all across the city.

Independent Mortgage Broker Specialized Loan Services

We are a group of professional mortgage brokers committed to assisting our Melbourne-based clients in obtaining a loan that meets their specific requirements. We are trusted by personal, corporate, and investment clients to acquire low rates from our broad panel of lenders because we are industry professionals with expertise and insight. Mel Finance is your best bet if you're looking for a mortgage broker in Melbourne.

The Financial Approach Of Mel

We deal with homebuyers in Melbourne and provide a high level of service and support. We'll treat you like a person, not a transaction, like a bank may. When some providers put their needs first, we put yours first. Mel Finance can help you avoid long wait periods, indifferent service, perplexing policies, and a rotating workforce. Our knowledgeable staff works with a panel of lenders to locate the best possible offer for you. Use our straightforward mortgage repayment calculator.

Clark Finance Group -Mortgage Broker Melbourne

1300 366 670

About Clark Finance Group - Mortgage Broker

Clark Finance Group was established to help clients understand the home loan process and discover the best mortgage option for their circumstances. We don't simply offer loans; we provide personalized lending solutions. We have accreditations with over 35 lenders, including all major banks and financial institutions, and access to over 600 different financial products.

Our Objective

To give our customers more options, better rates, clear guidance, and good old-fashioned human service. We believe that our service does not finish when your Loan is paid off, but rather when our relationship begins. We want to be your long-term financial experts by sharing your vision and assisting you in achieving your objectives more quickly.

Our Services

Clark Finance Group specializes in aiding first-time homebuyers with their property purchases. We are with you from the moment we first chat with you until you receive the keys to the door. Interest rates are at historic lows, and the government is providing more aid than ever before. There has never been a better moment to buy your first home. Get our free First-Time Home Buyers Guide now. Please feel free to distribute it to your friends, family, neighbours, coworkers, or anyone else you think would benefit from the information.

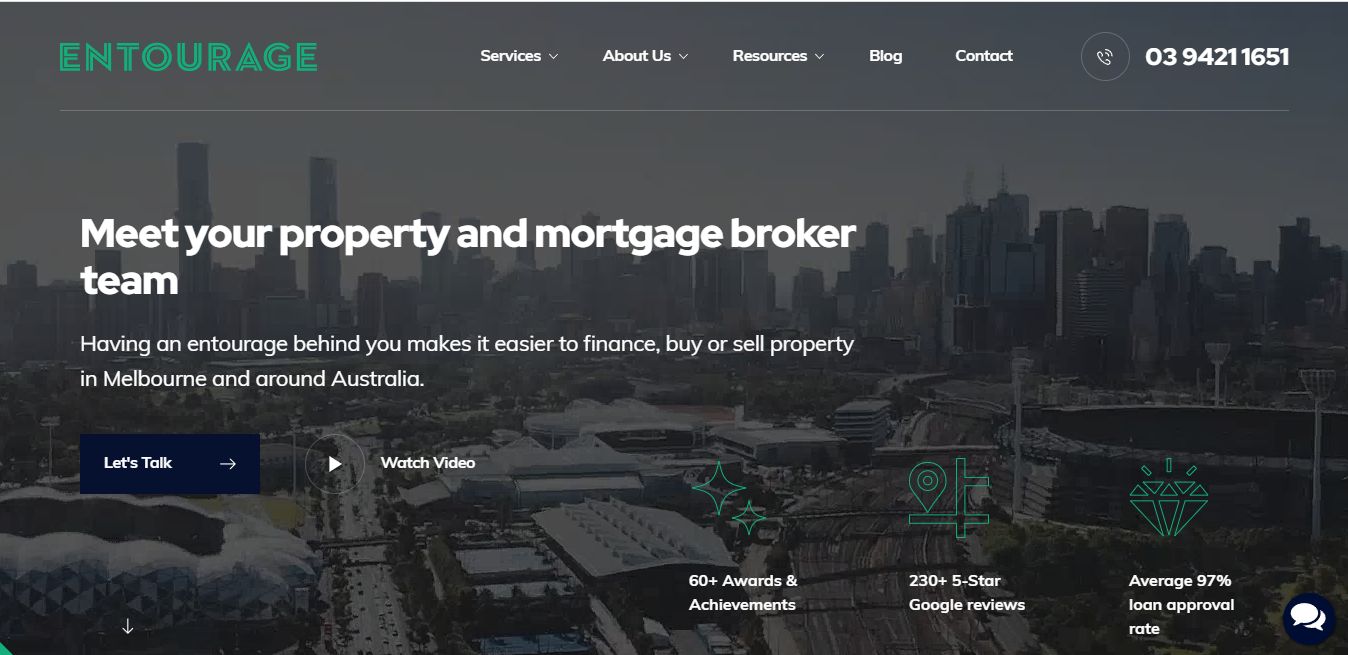

Entourage Finance - Mortgage Broker Melbourne

03 9421 1651

About Entourage Finance Melbourne

Award-winning service from a team that thrives on understanding your requirements. We'll find the perfect fit — whether it's a new house or the proper Loan to fund it — by listening and utilizing our experience to ask the right questions. Our in-depth research on your behalf removes the guesswork from property finance and allows you to focus on strategic thinking. As a result, our customers do not wait in line at the bank. Instead, they call someone who knows them better every year and makes everything simpler.

The Effect Of Entourage

When purchasing or selling a home, having a team of professionals on your side increases the potential rewards. Your companions will:

- Give you a leg up on the competition when buying or selling a home.

- Organize your home loan and finances with ease.

Our Service

First Home Buyer

Every step of the journey, we'll be there for you.

Putting money aside

There are several factors to consider when saving your deposit. From how much you'll need to save overall to how much you'll need to cover stamp duty and other charges, there's a lot to consider. Is it better to save the money or invest it in a term deposit? Investing in stocks? Or just keep it in a cupboard safe? Finally, you can use a method to maximize your savings and accumulate a substantial deposit in the shortest length of time.

Entourage helps you save time.

You only have so much time. So saving yours is one of the most crucial things we do. You have to enter your information once, rather than approaching five different banks and waiting on hold for hours to speak to the proper department.

Find the best Loan for you.

Not all mortgages are created equal. You have various features and pricing to pick from, just as you have a variety of banks to choose from. You don't have to worry about it in the end. Our responsibility is to be aware of the possibilities available and ensure that you leave with a smart financial framework that maximizes your assets and position. The correct Loan isn't about interest rates; it's about ensuring that you're prepared for the next big event.

Entourage Getting the most out of life

We get it. You may be purchasing your first house, but it is not your everlasting home, nor is it at the expense of your lifestyle. You might wait on hold for someone in a call centre in another country, or you could come into our swanky Cremorne office in Melbourne, order a glass of bubbly, and tell us about your great goals, grand dreams, and grand plan. Then we'll get to work for you and make it happen.

Mortgage Compare Plus - Melbourne Broker

0412 110 118

About Mortgage Compare Plus - Melbourne Broker

Steve Keramidas founded Mortgage Compare Plus in 2016. We started as a small business to make homeownership affordable and accessible to the average Australian. Our beliefs and philosophy reflect our goal of being a socially responsible organization. We are a firm that values performance with a purpose and is dedicated to believing that our financial situation is inextricably linked to our social and charitable responsibilities.

The Best Interests Duty, which went into force on January 1, 2021, requires brokers to act in their clients' best interests. This new regulation supplements the National Consumer Credit Protection Act, which governs broker behaviour. According to the law, if there is ever a conflict of interest, Mortgage Compare Plus must "prioritize their consumers' interests," according to the law. Mortgage Compare Plus is bound by the Best Interests Duty, whereas banks are not. Therefore, from all of the lenders on his panel, Steve Keramidas must provide his client with the best possible recommendation. On the other hand, a bank will only recommend its products, even if there are superior alternatives. When suggesting a house loan, Steve has a legal obligation to work in your best interests. So you buy items from banks.

Our Services

Service For No Charge

When advising on residential loans, our services as a mortgage broker are free of charge. Our complete service, which includes: advising and giving you information on loan products, negotiating the Loan on your behalf, and managing your paperwork through to settlement, is provided at no charge. However, in some cases, a brokerage fee may be charged to you, dependent on the complexity of your application.

Investment & SMSF Loans

Whether you're looking for rental income or capital growth, investing in property could be a great way to increase your wealth. For many, property is an accessible form of investment that is considered a safe and risk-averse strategy compared to many other asset classes.

In recent times, APRA's intervention for deposit-taking institutions to slow the growth rate of investor credit to below 10% has meant that it is more difficult for Australians to access investment loans. However, with an abundance of investment loans on the market, we can do the hard work and find a suitable investment loan for you, allowing you to enter the real estate market and take advantage of competitive investment loan rates.

Debt Consolidation & Refinancing

A shift in circumstances may mean it is time to revisit your home finances. There are various reasons to think about debt consolidation and home loan refinancing. These can include:

- Covering the cost of home renovations or a new home build

- Consolidating debts to take advantage of lower interest rates

- Finding a better deal or simply wanting to change lenders.

When you speak with us, we will do all the leg work and compare home loans from Australia's top banks and lenders. There may be a more suitable option that fits your financial situation and lifestyle better than your current home loan. The right refinanced Loan could help you pay off your mortgage faster and, for less, clear unhealthy debt or help you upgrade and add value to your home, which are steps in the right direction.

Personal Loans

A Personal Loan is a personal finance product where the financier lends the customer funds, which can be used to purchase a car, but does not hold any security over the Loan. A personal Loan can also be known as an Unsecured Loan. Personal loans include unsecured lending as well as secured lending. The Loan is taken out in the applicant's name. Personal loans can buy a car, motorbike or boat, debt consolidation, renovate your house, holidays, wedding and medical expenses. The great thing about personal loans is that they can fund almost anything, and a deposit is not required.

- Personal loans (ranging from $2,000 to $100,000) are evaluated individually and assigned a credit score, determining the interest rate.

- Loan repayments are frequently spread out during the Loan's life (term). A loan duration of one to seven years is available. It is recommended that you choose a shorter loan term to save money on interest.

- Secured and unsecured loans are available. Secured loans feature lower interest rates and are more secure.

Life Insurance

Term Life Insurance provides a lump sum payment if you pass away or are diagnosed with a terminal illness. This benefit is designed to help provide your family with financial security and, ideally will be sufficient to pay off any existing debts as well as provide funds to cover ongoing living expenses and other expenditures that will be incurred by your family and loved ones into the future.

Total and Permanent Disablement Insurance (TPD) provides you with a lump sum payment in the event that you suffer an injury or illness that is seriously enough to result in you being unable to return to work. The benefit is often used to repay existing debts, provide funds to help replace your loss of income and cover any potential medical or rehabilitation expenses. Trauma Insurance provides a lump-sum payment should you suffer any one of several specified serious injuries or illnesses, such as heart attack, cancer or stroke. The benefit is typically used to cover medical and rehabilitation expenses and to provide a financial buffer. Still, it can also be used to reduce debt, cover lost income or allow you to concentrate on your recovery.

Income Protection provides you with a regular monthly benefit designed to help cover your loss of income if you become sick or injured and are unable to work for an extended period. There are different ways to structure your income protection policy. You will have to choose the level of your benefit (usually up to 75% of your income) and the waiting period and benefit period. The waiting period relates to how long you must be unable to work before the benefit commences. The benefit period is the length of time the monthly benefits will continue to be paid, with the maximum benefit period generally being to age 65.

Energy & Gas Comparison

Mortgage Compare Plus has partnered with Econnex to provide you another way of saving $$$ off your bills. By visiting Econnex you can compare energy plans from their range of providers. Whether you want to save money or find a plan that works better for you, their friendly comparison engine is here to make the process easy for you.

- Saving money straight away by switching your energy retailer - Compare Energy Plans across the top retailers – Energy Australia, Alinta Energy, Agl, Powershop and much more.

- Switch online right now! No annoying phone calls - Three simple steps to switch and save (Enter your current usage, compare among several providers and switch).

- Get connected quicker – their system arranges it all - Find the Cheapest Energy Plans and make an informed choice.

Understanding Your Situation

Our initial meeting begins with familiarising ourselves with your entire financial situation, and your future plans. To assist us in doing this, ensure that you have your key documents with you when we meet, as this knowledge will help us find loan products that fit your lifestyle, whilst ensuring that it provides you with flexibility for any future changes.

First Home Buyer Loans

Buying your first property is an exciting and overwhelming process. With so many major decisions and choices, we do all the hard work and compare loans from a wide range of lenders and find the best Loan for you, making the whole process stress free and easy.

As a first home buyer, you may be eligible for a first home owners grant and stamp duty reductions. This is a grant available to Australian citizens or permanent residents who wish to buy or build their first home, which will be their principal place of residence within 12 months of settlement. Grant conditions do vary from state to state. We will also liaise with the lender, your conveyancer and your real estate agent. Basically, it's our job to do all the hard work and you can focus on finding the right home for you. We'll be there every step of the way to guide you through the entire home loan process – from application to approval.

Owner Occupied & Construction Loans

Buying property can be exciting and daunting at the same time. We're here to help to ensure you're armed with the right information to help you make the right decisions. We have access to hundreds of loans from a wide variety of lenders and will work with you to find the Loan that suits your individual circumstances. There are literally hundreds of home loans available, with new products emerging all the time. As a broker, we can help you find a loan that suits your particular needs, help you complete the paperwork, professionally package it with your supporting documents and submit it to your chosen lender. If you are looking to build your new home rather than buy an existing property, you need a different type of home loan known as a construction loan. A construction loan can also suit you if you are making major renovations to your existing home or to a property you have bought but which needs a bit, or a lot, of work before you call it home.

FreedomLend - Mortgage Broker Melbourne

1300 66 55 95

About FreedomLend - Mortgage Broker Melbourne

Who Is Freedom Lend?

Freedom Lend is a non-bank lender. We are a team of passionate consultants who aim to achieve tailored solutions for you. We are 100% Australian owned and all our staff are local to Melbourne. When you contact us, you can be assured that you are speaking to someone you can relate to and not a call centre overseas.

What Does Online Loan Products Mean?

100% online will help you access our products at the most convenient times for you. You can complete our easy applications at your convenience at whatever time you want. Our online presence allows for smaller commissions which we then pass on to you as lower rates. Our online presence is not restrictive, and we are backed by dedicated consultants that can answer your concerns and if you like, we can schedule for Skype or face-to-face meetups in Melbourne. We are here as an innovative solutions and to compete with the larger banks.

Our Variable And Fixed Loans

How do we achieve these rates? The answer is simple but many lenders do not have the same drive and innovation as we at Freedom Financial. We strive to achieve better rates by passing on a significant portion of the upfront commissions and all of our trail to benefit you and your family. By working on a smaller margin, we help you in our reduced interest rate for both variable and fixed terms.

Our Services

Freedom Variable Loan Features

Excellent Rates

Low interest rates allow you to spend on what you want rather than unnecessary luxuries.

Buying and refinancing

We have the ideal programme for you, whether you're buying a new home or refinancing your current one.

Product Division

Extra dividers make it easier to set up your finances.

Offset 100 percent

You get an unlimited number of free transactions per month with no minimum.

Payment Options

Weekly, biweekly, or monthly.

LVR of 95 percent

Our home loans allow for a loan-to-value ratio of up to 95%.

Intuitive Finance -Mortgage Broker Melbourne

1300 342 505

About Intuitive Finance Melbourne

We work with a wide range of clients, including first-time buyers, homeowners looking to upgrade, sophisticated investors with large property portfolios, and Australian expatriates living and working abroad who want to establish a property portfolio in Australia. We have a special interest in the self-employed, who, despite the difficulties in determining their capacity to maintain an investment, are comfortable with complex financial strategies and have an entrepreneurial mindset. We are particularly focused on our service standards for both new and existing clients at Intuitive Finance. All of our customers have specific goals in mind, and we are dedicated to providing you with the best possible loan "experience." We also keep you updated at every step of the loan process, including a post-closing follow-up. We also ensure that we contact you annually for a review and assessment of an RP Data property report for your portfolio if you are an existing client.

What Do We Do?

Basic variable loans typically offer lower interest rates and fewer features than the standard variable loans. You often have the option to pay for any additional feature required. Interest rates and repayments will vary throughout the loan term.

Advantages

- Relatively low interest rate

- Lower repayments

- Extra repayments allowed

- Redraw facility often provided

Disadvantages

- Many of these loans do not have the same features or flexibility as other variable loans

- Generally don't have an offset account

Home Loan Experts - Mortgage Melbourne

1300 889 743

About Home Loan Experts - Mortgage Melbourne

Mortgage Melbourne - Home Loan Experts. Why should you work with us as your mortgage broker? We want to reflect the absolute best of what it means to be a mortgage broker: providing exceptional service and customizing home loan solutions that improve our clients' lives.

We Approve Even The Most Difficult Loans.

Our expertise is in assisting customers with unexpected circumstances, including those who had previously been denied by a bank. We often obtain approval from a credible lender where other brokers have failed.

Get The Best Home Loan For Your Situation.

When evaluating your financial condition and long-term aspirations, we adopt a holistic approach to ensure that you get the best home loan possible.

Get Fantastic Interest Rates

We may negotiate a low interest rate based on the basis of your application because of our contacts with our panel of lenders.

Quick Approval, Simple Procedure

We can guide you through the often complicated pre-approval and application procedure, making your dream of owning a home a lot easier and faster.

Our Clients Adore Us.

On our website, Facebook, Google, and Product Review, we have hundreds of love letters and good customer reviews.

Our Notable Accomplishments

Several industry and consumer awards have been bestowed upon us, including outstanding customer service and brokerage of the year.

You Can Rely On Us.

It's difficult to determine who to trust in a crowded market. We often contribute expert analysis to the Sydney Morning Herald, The Age, news.com.au, The Adviser, and Australian Broker as experts.

A Bank Does Not Own Us.

Our knowledgeable mortgage brokers will offer you practical home loan advice, and as a credit licensee, we are mandated by Australian law to provide you with a loan that meets your needs.

We Offer The Best Post-Settlement Service Available.

Our post-settlement staff is available to help and advise you throughout the life of your mortgage. We not only respond to all of your post-settlement questions, but we also assist you in making adjustments, additions, and modifications to your loan type.

More Lending Options

We work with all of the main banks, as well as a number of building societies, credit unions, and specialized lenders who offer lower rates and more flexible credit policies than most other brokers.

Services Throughout Australia

We can assist you in obtaining a house loan to purchase a property anywhere in Australia.

Free Credit Reports And Upfront Valuations

We can offer you a good idea of how much the bank will lend you and how to overcome the obstacles to getting a house loan approved.

We Are Fbaa And Afca Members.

Our membership with the Australian Financial Complaints Authority (AFCA) protects you as a consumer.

We Work For Your Benefit.

You can rest easy knowing that, under the Best Interests Duty, we are legally obligated to act in your best interests, whereas a lender is not.

What Do We Do?

In Most Circumstances, Our Services Are Entirely Free.

For most house and investment loans, our services are entirely free. Only certain forms of short-term loans, minor loans, some types of commercial or trust finance, and if you refinance or otherwise exit your home loan during the first two years will we charge a brokerage fee. We are compensated by the lender for work that would otherwise be performed by a bank manager, so you will pay the same rate as if you went straight to the lender. Unlike a bank, however, we can assist you in selecting from a wide range of lenders and determining the best solution for your needs from our panel of over 30 lenders.

Services Throughout Australia

Are you in the woods? Interstate? Overseas? It makes no difference to us! We can help anyone in Australia who is buying or refinancing a home. Our operations have been streamlined to allow us to quickly process your application via mail, phone, fax, or email. Applicants from all states of Australia, particularly NSW, VIC, QLD, and the ACT, are common. Foreign nationals, Australian expats, and temporary residents can also use our services to purchase owner-occupied or investment properties in Australia.

Tundra Mortgage Brokers Melbourne

1300 447 010

About Tundra Mortgage Brokers Melbourne

Tundra Mortgage Brokers is your one-stop-shop for dependable broker services in and around Melbourne. We can assist you whether you are a First-Time Home Buyer in need of guidance or a Home Owner looking to refinance your current mortgage.

What are our identities? Our small team of financial specialists, based in Melbourne, has formed partnerships with many of Australia's biggest lenders. We can find the proper opportunities for our clients and their conditions by depending on our knowledge, as well as contact lenders directly to get mortgages. Above all, it is our degree of expertise that we take pride in.

What Can We Do?

Unlike our competitors, we try to provide a comprehensive set of services without compromising the quality of each one. We accomplish this by keeping our knowledge current and well-maintained while developing our existing talents. Rather than spreading our resources thin across a number of services, we choose to utilize our team's skillsets to provide a greater degree of understanding and experience while assisting our clients. This means we can customize our services to meet your needs, whether you want to remain on top of the newest interest rates, leverage our lender ties, or have our team handle all correspondence while reducing your stress.

Lime Financial Services- Mortgage Broker Melbourne

1300 724 088

About Lime Financial Services Melbourne

What is the next step in your financial path? Are you looking to buy your first house, invest in real estate, expand your business, or consolidate your debts? You need to know what step to take next in the world of financial, how to take that step, and who you can trust to provide you the best advice. We've been your mortgage and money experts since 2005. Our team offers unbiased, targeted advice as well as long-term financial planning services to assist you take the next step.

We offer the access and knowledge to help residential and commercial borrowers from all walks of life through our partnerships with big banks, credit unions, regional banks, wholesale funders, and online lenders. Whether you're a sole trader, own a business, or work for a living, our staff can help you achieve financial success. We'll suggest the best product, handle all the paperwork, and provide a comprehensive financial solution. Take the mystery out of the mortgage process and take control of your finances. For a no-obligation chat regarding your circumstances, contact Andrew Burgan and the Lime Financial Services team.

Our Services

Property Investment Mortgage Broker Melbourne

Your house loan is one of the most critical factors to consider when buying an investment property. You may start making money from your new home right away with the right investment loan, and you won't have to worry about high fees or interest rates. Lime Financial Services provides expert guidance and recommendations to assist you in obtaining the finest investment loan. We can: Using our vast resources and years of experience:

- Assist you in determining whether an investment property is right for you.

- Choose the finest investment loan for your needs.

- Assist you with various elements of your property purchase.

Lime Financial Services, as your specialist investment mortgage broker in Melbourne, will fully explain all of your alternatives with no expenses, no pressure, and no obligations. Our services are completely free, and we handle all of the lenders and paperwork so you don't have to. We're a mortgage company.

Buyers of First Homes

First-Time Homebuyers Education, Grant Processing, and Low Deposit Loans

Entrepreneurs

Commercial Real Estate, Business Loans, Equipment Financing, and Automobile Leases

Debt restructuring and refinancing

- Reduce your repayments and interest rates will be cheaper.

- Interest-Only Loans, Equity Release to Fund Property Deposits, and Fees for Property Investors

Home Improvement Contractors

Buying a bigger house for the family.

Superfunds that are self-managed

Purchasing an Investment Property Using Superannuation.

- Long-term strategy, insurance, superannuation, and budgeting are all aspects of financial planning.

- Conveyancing is the legal process of transferring property from a seller to a buyer.

- Estate planning, wills, powers of attorney, and family law are all legal issues.

- Accounting - We pair professionals with your specific requirements. Property investors and SMSFs, for example.

- Real Estate – Professionals who can help you find a home.

- Building, Home Contents, Landlords, Business, and Liability are all types of general insurance.

Victorian Mortgage Brokers Group Melbourne

03 8600 7900

About Victorian Mortgage Brokers Group

The Victorian Mortgage Group is a family-owned and operated company. We've been giving hope to borrowers who have been turned down by the big banks for over 75 years. We've helped numerous families protect their future by taking a flexible approach to assessing their finances. Under Crucis Pty. Ltd.'s Australian Credit Licence 387 666, we are an Authorised Credit Representative (number 398 125). Our employees have extensive knowledge in all aspects of banking and finance. Our ability to anticipate, comprehend, and handle any challenges that arise during the lending process will benefit you. We are more than prepared to assist you, having financed over 30,000 homes to date. VMG pays attention to your story. We recognize that people confront unique circumstances, and we build long-term relationships with our clients to guarantee that they receive the individualized care they deserve.

Our Services

Our team of finance experts specializes in offering borrowers with flexible financing solutions to assist them accomplish their financial goals. In today's mortgage market, it's vital to work with a firm that is not only secure, but also has a lot of experience. For over 75 years, we've been assisting Australian borrowers overcome obstacles as a family-owned and operated business. We also have the particular advantage of flexibility, unlike other private lending companies. Because we specialize in near-prime home mortgages, flexibility is essential. We lend our own money to borrowers who may not match the major lenders' typical lending criteria. Our service has been refined over time, and our clients benefit from our ability to foresee, comprehend, and address any concerns that may arise during the loan process.

At Vmg, We Strongly Believe In The Following Ideas:

- Quality\sIntegrity

- Continuity

- Value

- Personal Attention

We Are Capable Of Managing The Entire Mortgage Process:

- Quality

- Integrity

- Continuity

- Value

- Personal Attention

Key Choice Group Mortgage Broker Melbourne

(03) 4329 0901

About Key Choice Group Mortgage Broker

We assist ambitious, hardworking Australians in navigating the financial jungle and negotiating better terms with banks. Whether you want to invest in your business, buy your forever home, or expand your real estate portfolio, we're here to help. We serve customers from all across Melbourne and beyond from our beautiful Mornington Peninsula location.

Innovative Financial Strategies

There's more to a loan than just the interest rate. Our customized solutions are designed to help you achieve your long-term investing goals. We also assist in removing the tension from the procedure so you can focus on more essential matters.

For A More Fulfilling Life And Career

Wealth production is not limited to the wealthy. We work with ambitious people who want to grow their property holdings or invest in their businesses in order to assure a brighter future.

Our Services

Invest In My Company.

Making the decision to invest in your company requires a solid strategy and competent advice.

- analyzing your p&l and making strategic recommendations

- increasing your borrowing capacity and improving your credit score

- negotiating favourable arrangements with lenders

Purchase A House

We can help you use your hard-earned equity to acquire your next property, whether it's a fixer-upper or your ultimate dream home.

- taking advantage of your equity and payment history

- looking for an exceptional solution on the market

- negotiating with the lender for a better outcome

Loan Refinancing

The loan package that was great for you five years ago may no longer be the best alternative for you. Taking use of our up-to-date financial expertise makes sense.

- examining the current debt structure

- getting a better deal from your present lender

- obtaining competitive offers from different lenders

Invest In Real Estate

If you have the right framework in place to maximize negative gearing benefits, investing in property can help you achieve financial independence.

- creating a strong loan application

- increasing cash flow and borrowing power

- choosing the correct loan structure for you

Picket Fence Mortgage Broker Melbourne

03 9696 3007

About Picket Fence Mortgage Finance

Picket Fence Finance was founded in 2011 by Cameron Stillman and David Kearns, who had a vision to channel their decade of successful mortgage broking experience into a company that offered clients long-term financial outcomes underpinned by first-class service tailored to individual needs and expectations. It didn't take long to gather a cohesive team of like-minded individuals, thanks to an industry-wide reputation for ethical and professional conduct and a clientele founded on repeat business and referrals. Picket Fence Finance now employs a diverse group of competent individuals who share their passion, beliefs, and overall corporate culture. Picket Fence Finance has been synonymous with mortgages in Melbourne's Bayside and South-eastern neighbourhoods thanks to our personalized service and exceptional product knowledge.

With accolades and recognition from banking and industry factions such as 'Platinum Broker Westpac 2014,' 'Editor's Choice Winner 2014,' 'Victorian Broker of the Year Bankwest 2014,' and 'Premium Broker ANZ 2016,' the multi-award-winning partnership of Stillman and Kearns is dedicated to maintaining Picket Fence Finance's strength and stability in a fast-paced, ever-changing industry. Picket Fence Finance, which provides a suite of services to manage the lifespan of a mortgage, has access to over twenty major mortgage lenders, with several of them giving them privileged access to a range of additional products and services not available to the general public.

Picket Fence Finance's team uses its up-to-date product knowledge and skills to review and assess client circumstances on a case-by-case basis, focusing solely on mortgages and putting an emphasis on their clients' long-term financial needs. They take the time to get to know their clients' unique needs and goals in order to match them with the best mortgage.

However, this is only the beginning of our assistance. Picket Fence Finance views our customer relationships as long-term partnerships, determined to raise the standard of client expectations and counter the stereotype created by'slam dunk' style outfits. Our differentiator is our motto: "The grass is greener on the other side of the fence." A client of Picket Fence Finance can expect:

- A higher degree of personalized service that includes a Customer Loyalty Program and other perks.

- Regular loan evaluations, emphasizing opportunities to save money on interest.

- Access to partnered services, such as conveyancing services, that have been hand-picked for their location and customer compatibility.

- Knowledge, advice, and service from a knowledgeable team dedicated to continual product training and professional development in order to stay current with industry trends and changes.

- Confidence in working with a transparent organization that follows industry best practices and is committed to putting our customers first at all times.

- To be associated with a company that is represented by the Mortgage & Finance Association of Australia, a premier national group that provides services to professional finance brokers (MFAA).

Picket Fence Finance has its sights set on the future. We want to be one of Melbourne's most respected mortgage brokers, not just for our ability to find the best mortgage for our clients, but also for our charitable activities.

What We Offer?

Mortgage With A Basic Variable Rate

A no-frills mortgage with a cheaper rate, as the name implies, which usually means fewer features and less flexibility.

Mortgage With A Standard Variable Rate

This is the most typical mortgage, and it comes with the lender's regular quoted rate. This may alter over time as financial markets and interest rates shift, affecting the amount of your monthly mortgage payments. An offset account, a redraw facility, or a waived or reduced application fee may be available with this mortgage.

Mortgages With Fixed Rates

Many lenders may allow you to lock in your mortgage rate for a period of one to five years. If you believe interest rates will rise, you can protect yourself by ensuring that your repayments do not increase during the time period you specify.

Mortgage With Two Rates

A variable and fixed-rate combination. The fixed-rate is for a set length of time.

An Interest-Only Loan

You just pay the interest on the amount borrowed, usually for a period of one to five years. This type of mortgage is used by investors who expect capital growth when a property is sold to pay off the principal.

Mortgage For Beginners

This mortgage, sometimes referred to as a "honeymoon" rate, is geared specifically at first-time home buyers and gives a low, discounted rate for an initial "honeymoon" period – usually 6 to 12 months – before reverting to the lender's ordinary variable rate.

Mortgage With A Credit Line

This type of Loan, also known as an equity loan, allows you to access the equity in your home by using it as collateral for the Loan. You can normally draw down all or part of your credit limit on a come-and-go basis, with interest calculated only on the amount borrowed.

A Low-Doc Loan

Designed for self-employed individuals, and so named because the lender waives part of the proof-of-income paperwork that are generally required to apply. Typically, a rate higher than the standard variable rate is charged. These loans are no longer as common as they once were.

Benevolence Financial Group Melbourne

1800 975 054

About Benevolence Financial Group Melbourne

We observed the effects and discoveries of the Royal Banking Commission while working in banking. Benevolence Financial Group was formed with the sole purpose of "What if the most mistrusted industry become the leading force for sustainable change in the world?" with a strong sense of responsibility and desire to make the world a better place. Benevolence Financial Group is Sydney's first and only social enterprise mortgage brokerage firm, specializing in house loans with a mission, with 50 percent of revenues going towards building affordable housing for low-income families. We call it a house for home because when you receive a mortgage, another family builds a home. Our goal is to assist 1% of Australian homebuyers by 2030, which corresponds to approximately 60,000 families entering the housing market and more than $50 million in donations over the next ten years. That equates to hundreds of families in Australia or sixteen thousand in Asia Pacific (each house costs $3,000 in Asia Pacific).

Our Service

We witnessed the Royal Banking Commission's effects and discoveries as bankers. Benevolence Financial Group was formed with the sole purpose of "What if the most mistrusted industry became the leading driver for sustainable change in the world?" Benevolence Financial Group was founded with a profound feeling of responsibility and a desire to make the world a better place. Benevolence Financial Group is Sydney's first and only social enterprise mortgage brokerage firm, specializing in house loans with a purpose, with 50% of revenues going to help families in need. When you receive a home loan, another family builds a home for you. Our goal is to assist 1% of Australian homebuyers by 2030, which would result in over 60,000 families entering the housing market and more than $50 million in donations over the next ten years. This equates to hundreds of households in Australia or sixteen thousand in Asia Pacific (houses in Asia Pacific cost $3,000 each).

Yellow Brick Road Mortgage Melbourne

1800 927 927

About Yellow Brick Road Mortgage Melbourne

Yellow Brick Road was founded to assist ordinary Australians in using property purchases to build wealth. I intended to combine a variety of mortgage products and services into one company. Yellow Brick Road can help you reach your property goals, from a first home to an investment property to support you in retirement – and anything in between. Our nationwide branch network in Australian suburbs and towns where people live and work is the most significant component of the Yellow Brick Road tale. By bringing varied services together in one location, we are committed to putting clients at the centre of our business. As part of this business model, we provide our customers with access to home loan professionals they can trust and rely on throughout their house buying process: our experienced mortgage brokers.

Our Services

We collaborate with you to make your home loan process as simple as possible! We recognize that each borrower is distinct. We are confident in our ability to find you a solution, whether you have great credit and are seeking the best rate, are a small company owner, or have a less-than-ideal credit score. We take the time to learn about your unique difficulties and objectives in order to discover the appropriate home loan for your needs.

Important Choices Variable rate offered for owner-occupied loans up to a 65 percent LVR, PAYG applicants only, loan sizes $250,000 – $750,000. The comparison rate is based on a $150,000 loan with a 25-year duration. WARNING: This comparative rate only applies to the samples provided and may not apply to other fees and levies. A different comparison rate could come from differing terms, fees, or borrowing amounts. Information and interest rates are current as of 08/02/21 and are subject to change for new customers only. Terms and restrictions apply, as well as taxes, levies, and credit criteria. Yellow Brick Road Finance Pty. Limited ACN 128 708 109 Australian Credit Licence 393195 provides this information, which does not take your personal objectives, financial condition, or needs into account. Consider if it is suitable in light of these factors before taking action. The pricing listed above are subject to change. Fees and charges must be paid. Your local branch can provide you with the terms and conditions.

RateOne Mortgage Brokers Melbourne

1300 788 364

About RateOne Mortgage Brokers Melbourne

RateOne Financial Services is a full-service financial services firm specializing in mortgage broking, financial planning, and asset finance. Our mission is to provide new and existing clients with an innovative and long-lasting financial service relationship focused on the development and protection of their most significant assets: family lifestyle and wealth. Our knowledgeable team at RateOne focuses on empowering and educating our clients so that they may take charge of their financial destiny. We're here to make your RateOne experience beneficial, whether you're thinking about refinancing your existing Loan, buying a new home, or need financial planning or risk insurance assistance.

What We Offer?

Purchasing

Because lender regulations, products, and pricing can change on a weekly basis, getting the appropriate counsel for your first house is just as critical as it is for your tenth. When you first bought, your current lender most likely checked all of the necessary boxes. A evaluation of your situation before making any new purchase is a good and reasonable line of action to more precisely account for your current financial circumstances. We'll examine your existing needs and present the finest alternatives accessible to you, whether you're a first-time homebuyer, upgrading to a new house, expanding your property investment portfolio, or preparing to build your property.

Personal Budgeting

With a personal loan, you can get there faster. An extra financial boost can help you achieve your goals or make exciting life changes.

Lifestyle

Although a home loan is often a long-term investment, refinancing your mortgage may make sense in certain circumstances. Refinancing is taking out a new loan and utilizing the proceeds to pay down your old one. During the refinancing process, your broker will examine your other debts to see if consolidating your more expensive loans into the home loan may be helpful. This can help you save money and make large financial benefits over time. A reverse mortgage is another type of refinancing; this financial product allows you to borrow money using the equity in your property as collateral. The Loan can come in the form of a flat sum, an income stream, a line of credit, or a mix of these. Interest is levied in the same way as any other loan, but you normally do not have to make payments while you are still living in your home.