Abletax Business Solutions – Small Business Tax Return & Accountants Cheltenham

September 9, 2021 | Accountants | Cheltenham

Email: admin@abletax.net.au

Website: https://abletax.net.au/

Phone: +61385210601

Why Choose Us?

Abletax Business Solutions prides itself in making sure that all clients’ taxation and business needs are taken care of efficiently and promptly in a friendly and professional manner.

- Personalised Service

- Competitive Rates

- Easy Efficient and Hassle Free

- One Cost Effective Package

- No Time Billing

- Latest Technology

About Us

Abletax Business Solutions is a small but professional business that prides itself in making sure that all our client’s taxation and business needs are taken care of in an efficient and cost effective manner that takes the stress out of tax. We know only too well the challenges facing small business and always encourage frequent communication to keep on top of tax and identify areas for concern or improvement.

For business we provide the full gamut of services from accounting, bookkeeping, tax & tax planning to business advisory. We consider ourselves a one-stop solution for all your accounting needs and aim to help your business grow in line with your finances. We will liaise with the ATO for you when cashflow is tight and put plans in place to minimise tax and budget for BAS and tax obligations. We are aware of the all latest small business tax concessions so we can identify where they can be utilised in your business, or how you can restructure your business to make the most of the concessions in the future.

For individuals we offer online services for your tax preparation, coupled with phone or email correspondence so it is extremely convenient and easy or you can drop into our office if you prefer face to face service or a bit of extra advice. We will ensure that all allowable deductions are claimed so you get the maximum refund possible or the least tax payable possible!

Accounting Services Cheltenham, Melbourne

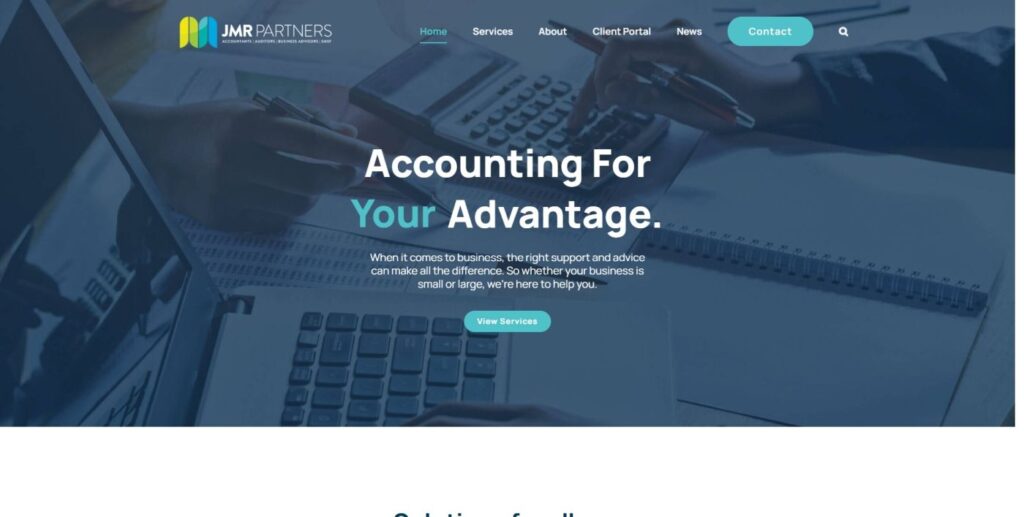

Grow Your Future Prospects with Trusted Accountants in Cheltenham

The role of accounting is not limited by numbers. It provides a deeper understanding of your business’ performance and current position. In fact, reliable accounting generates enough financial information to help you form future business plans and strategies.

A trusted accounting firm will help you grow your business prospects. And by providing the most reliable financial information, a qualified accountant will help you analyse your progress towards your business goals.

An accountant will also assist with goal planning for the future. Apart from this, an accountant in Melbourne will help you form strategies that can accelerate your financial growth, further assisting you to get one-step closer to achieving your dreams related to personal and business growth or retirement.

Bookkeeping Services

We can take care of all the compliance, offer software solutions, keep your books up to date, lodge your BAS, your annual tax returns, your Taxable Payment Annual Reports (TPARS), payroll, everything to do with running your business.

Our Bookkeeping Services includes:

- Cloud Based Accounting Solutions

- Software setup and training

- BAS and Tax preparation

- Taxable Annual Reports (TPARS)

- Payroll and STP reporting

- Budgets and tax planning

- Preparation of financial statements

- Financial Performance Reports

- Business Health Check

Tax Returns

For business we provide the full gamut of services including tax return. We consider ourselves a one-stop solution for all your accounting needs and aim to help your business grow in line with your finances. We will liaise with the ATO for you when cashflow is tight and put plans in place to minimise tax and budget for BAS and tax obligations. We are aware of the all latest small business tax concessions so we can identify where they can be utilised in your business, or how you can restructure your business to make the most of the concessions in the future.

As registered tax agents we will keep you compliant with all your tax obligtaions. To enable efficiency we are certified with latest accounting software including Xero, Quickbooks and MYOB. We are members of the Institute of Public Accounting,Tax and Super Australia and The National Tax and Accountants’ Association (NTAA).

Business Advisory and Start-ups

We can offer advice on the different business structures to meet the vision you have for your business so you are not stuck in a structure that limits future growth. If you are already established and wish to restructure we can help you do this by utilising the small business restructure rollover so you are not hit with capital gains on the changeover, as well as advise on structuring to best take advantage of the small business tax concession in years to come.

Self Managed Super Funds

SMSF’s can offer a wide range of investment opportunities and flexibility and give you the satisfaction of having control over your own superannuation funds, however with the constant changes to legislation the burden of compliance can be overwhelming. The consequences of breaching the rules can be financially crippling so it is important that you are well informed and your SMSF is compliant. We can help you achieve this. We use the latest technology to manage your fund which allows us to monitor transactions for compliance in real time and we routinely attend seminars to keep up to date with rules and tax saving strategies. Our external auditor has fixed rates and our fees are also very competitive so you will never be overcharged for our SMSF services.

Tax Planning and Advice in Cheltenham

Save Up on Taxes with Effective Tax Planning and Advice in Cheltenham

When you are a small business, the challenge is trying to increase your profits while managing the ongoing expenses. The tax season can bring an additional burden on your cash flow, however, with a bit of tax planning and some good processes in place, the impact is manageable. We can evaluate your financial situation to help stay on top of your taxes, and implement tax effective strategies to make sure that your bottom line is maintained. In this way, you can pay taxes on time while reducing the tax burden and securing a positive P&L statement. Moreover, you can concentrate on other aspects of your business and leave tax planning and advice up to trusted professionals. Similarly if you are a salary worker of self-funded retiree and have investment income you do not want to be surprised by an unexpected tax debt at year end or pay more tax than you need to. We will can help you implement strategies to reduce and manage anticipated tax so you are never left wondering why you are hit with such a large bill from the ATO that you have not budgeted for.

CTA + Interlinking + Advertising Section

You’ll also like these [CATEGORGIES]

Best wedding DJ's

Best wedding MC's

Best Wedding Videographers

Some of the most popular wedding suppliers [POSTS] are:

John Smith Wedding Photographer

John Smith Wedding DJ

John Smith Wedding Wedding Dress Shop