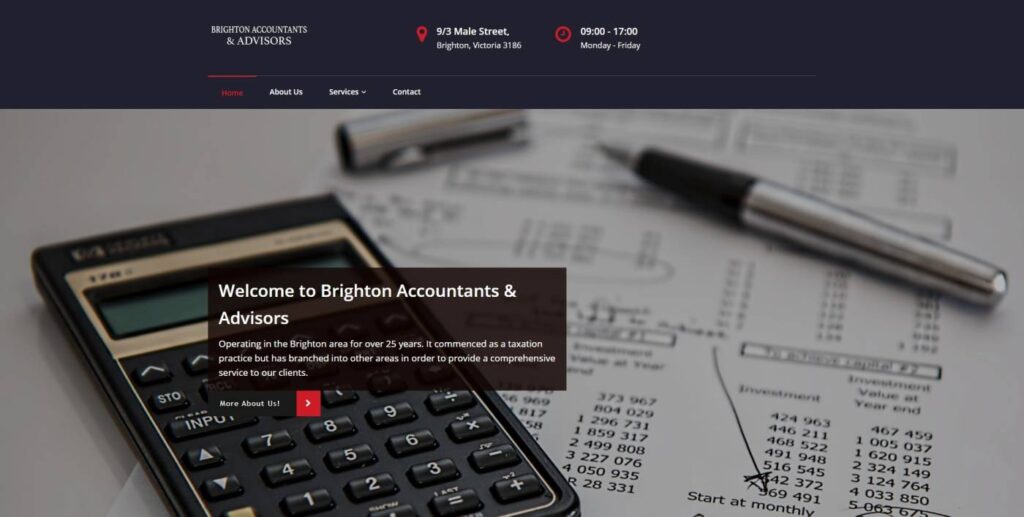

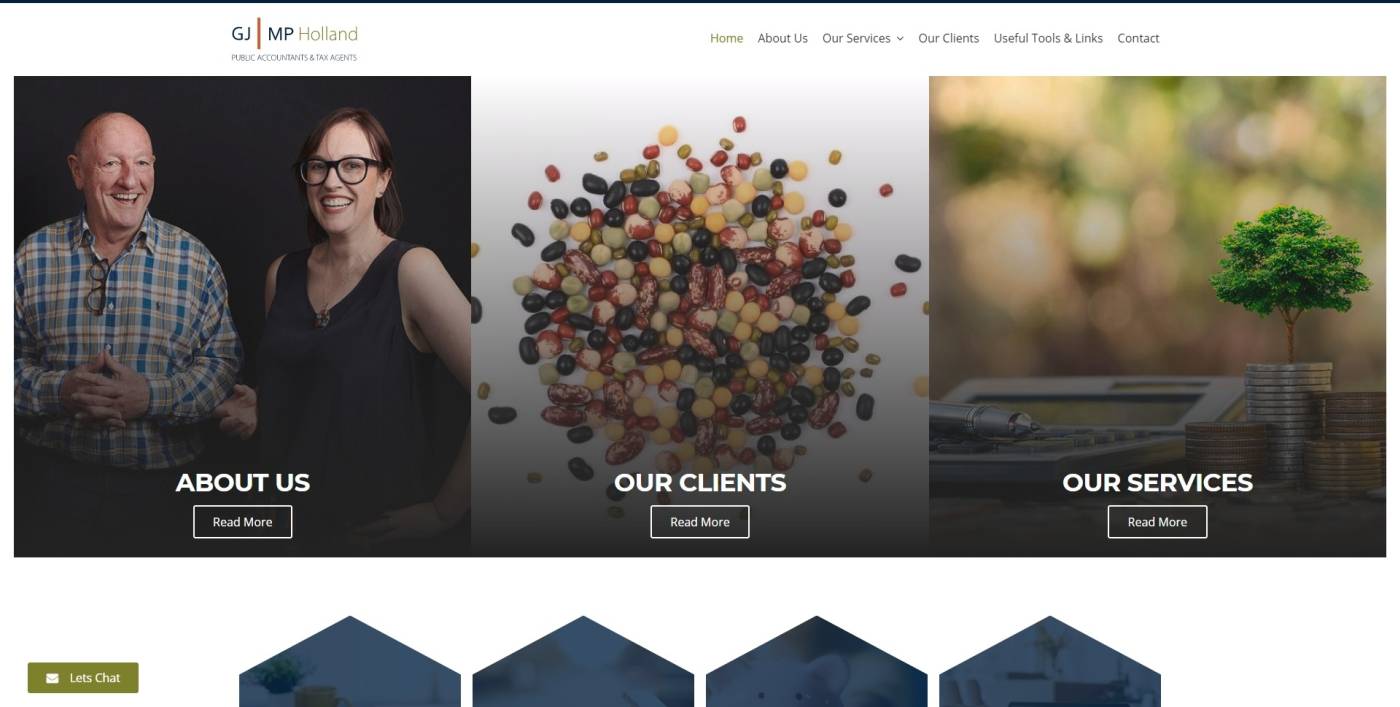

GJ & MP Holland

August 19, 2021 | Accountants | Brighton

Email: tax@gjmph.com.au

Website: https://www.gjmph.com.au/

Phone: +61395967241

We are a family business.

In 1945 George Holland returned home from his time at war to welcome his first child, Margaret, and to begin his Accounting career. In his early days in practice, he would take the train to regional areas of Victoria, primarily around Nhill, and walk from farm to farm sourcing clients to build his business. Proudly, some of these families are still clients of the practice today.

When George’s son Michael joined the practice in the late 1970’s, GJ & MP Holland was born. The business grew into a flourishing family practice and became an important part of Gardenvale’s local business hub.

The practice looks quite different today.

Fiona (George’s granddaughter) joined the team with Michael and took over the practice in 2017. Her father Iaan, who trained with Michael many years ago, then joined Fiona. Iaan brought his many years of accounting and auditing training, experience (and clients). Fiona continues to build and maintain strong relationships with Michael’s clients, as well as welcome newcomers to the business. The evolution of the Holland (and Dick) family practice continues.

Business Structures

Deciding on a structure is an important first step when setting up a business – it is also one of the most daunting. We can help you structure the legal and financial aspects of your new business. We have assisted many start-up businesses with the following:

- Deciding on the most suitable structure for your business – Sole trader, partnership, or a limited company. It is important you start your business with the right foundation to achieve your goals

- Prepare a business plan, cash flow projections, budgets, and trading forecasts

- Assess your finance requirements, advise on the best sources of finance, and draw up the necessary proposals

- Business & personal risk mitigation and asset protection

Business Formation

Once you have decided on a structure we can assist you with:

- Australian Business Number and Tax File Number registration

- Completing registration procedures with the Australian Securities and Investments Commission

- The management of your ongoing company secretarial obligations

- Setting up a recording system for your internal use and for complying with statutory requirements

- Financial modelling and forecasting to help you come up with a realistic picture of cashflow and capital needs

- Identifying risk factors to your industry and business model

- Short and long term planning and sustainable growth advice

- Building a strong working relationship with your bank

- Referrals to various lending specialists from our network if required

Cloud Accounting Solutions

We can help you choose the right technology solution for your business. A good cloud solution can put you in a strong position to fully realise your business potential. It should also allow you to spend less time with your head in the books and more time running your business. We partner with both Xero and MYOB and have experience with a host of other industry specific platforms.

Whichever solution you choose, it should:

- Facilitate up to the minute accurate reporting to track your business performance

- Help you understand your numbers at a glance

- Provide a level of data security

- Provide you with opportunities for improved efficiency through automation

If there are particular systems you use for invoicing or Point of Sale there may be opportunities to “App Stack” – integrate these systems with a cloud solution to build a dynamic user interface specific to your business needs.

Quarterly Reporting and BAS Lodgement

We offer a variety of services around monthly and quarterly BAS reporting:

- We provide training in BAS lodgement to give you the freedom to lodge these yourself

- We can provide full BAS support by reconciling, preparing and lodging BAS on your behalf. For many clients we provide support as needed and only with BAS variations and Ad HOC queries

- We are qualified in a full range of services and accounting software to keep all your business compliance up to date

Single Touch Payroll Compliance

Single Touch Payroll (STP) is a recent regulation that changed when and how small businesses report payroll activity to the Australian Tax Office (ATO). Historically businesses reported this information to the ATO at the end of the year. Now, they send a report each pay day. Those reports must be submitted digitally, using a very specific format. The setup and ongoing maintenance of an STP platform can be daunting.

We offer:

- Advice on setting up Single Touch Payroll to ensure you and your business are up to date and compliant

- A full service STP lodgement program for small businesses who need support with technology platforms

- Expert knowledge in the current and ever changing rules and regulations around STP as they are released by the ATO

Fringe Benefit Tax

FBT is paid by employers on certain benefits they provide to their employees or their employees’ family or other associates. FBT applies even if the benefit is provided by a third party under an arrangement with the employer.

We can provide advice around the best way to manage employee benefits to minimise FBT exposure.

Tax Returns

Tax compliance requires diligence and proactive work throughout the year. We are always up to date with legislative changes and Australian Tax Office policies. As well as full-service accounting work we offer once a year tax return preparation. We can help with your individual and business tax returns.

We keep ourselves abreast of all opportunities for industry specific deductions for individual clients all current concessions available for small business to minimise/defer tax payable.

Tax Planning and Advice

It is beneficial to be proactive and get some help with tax planning during the financial year. We can arrange tax planning meetings with our clients prior to June 30 each year to make sure you have the strategies in place to minimise unnecessary tax. We build a tax planning strategy for both the short and long term, tailored to your circumstances and future plans.

We can provide specific advice on many areas of tax law including:

- Small business capital gains tax concessions

- Capital Gains Tax and its impact on you

- Owner Builder and the tax implications of different choices you make along the way

- Employee share schemes

- Redundancy

- Fringe Benefits Tax (FBT) and salary packaging

- Research and development tax concessions

- Assistance with ATO tax audits and investigations

- Self Managed Superannuation Fund administration and regulatory compliance

Corporate Secretarial

We provide company secretarial services including expert advice and practical assistance in the setup and ongoing maintenance of companies and their boards.

Some of the services we can help with include:

- Registering a company (company formation)

- Business name registration

- Incorporation of association registrations

- Change of company details including company name, registered office/business address, officeholders and shareholders

- De-registrations

- Company and personal searches

- Preparation of Australian Securities and Investments Commission (ASIC) database updates

- Annual ASIC company statements.

We can register and establish companies, discretionary trusts, unit trusts and Self Managed Super Funds. We can help you interpret clauses within an entity’s constitution or deed to ensure proposed commercial transactions tie onto the framework.

Financial Reporting

As part of the tax return preparation for business we review your financial position and prepare an adjusted set of Financial Statements. In addition to this yearly service, we can work with you to understand your goals so we are able to:

- Understand your unique financial reporting needs

- Prepare all financial statements required to fulfil your internal reporting requirements

- Provide professional financial statements ad hoc to present to lenders, stakeholders or potential investors

- Conduct a financial statement compliance audit to identify any possible risks

CTA + Interlinking + Advertising Section

You’ll also like these [CATEGORGIES]

Best wedding DJ's

Best wedding MC's

Best Wedding Videographers

Some of the most popular wedding suppliers [POSTS] are:

John Smith Wedding Photographer

John Smith Wedding DJ

John Smith Wedding Wedding Dress Shop